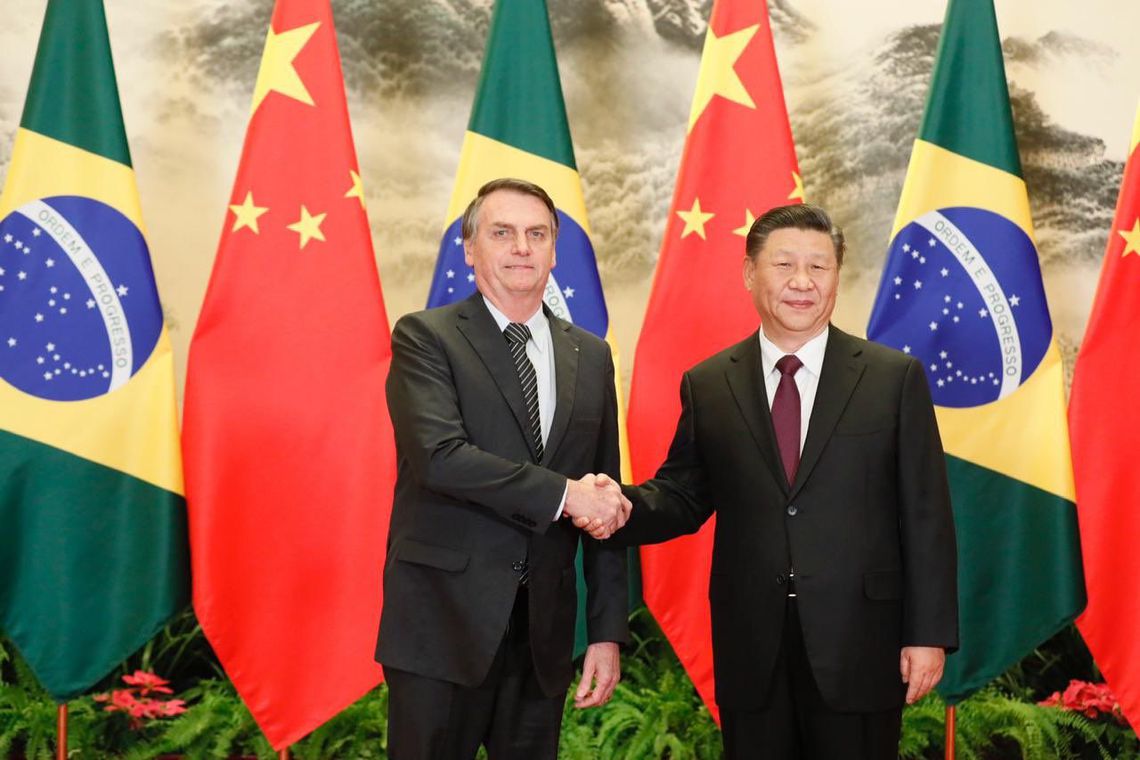

Bolsonaro’s first year – I was wrong about China, but right about the banking industry

At the end of 2018 I posted some predictions about Bolsonaro’s election and about the policies he was likely to pursue. This is the review and critique of that forecast. No dictatorship, etc. Of course not. This “threat” has always been propaganda. Restrictions on the purchase of land by Chinese investors I didn’t get it quite right. I assumed the military sectors would try to impose restriction on the purchase of land, due to nationalistic ideology. Reality, however, was much more complex. I couldn’t notice that: a large number of congressmen were interested in developing connections with China. Several have even visited China; the army was busy dealing with the reform of pensions and issues with indigenous peoples; the market had already adapted to the current legislation and there was no pressure that could trigger a government response. And, finally, I wasn’t aware of the signs of Trump’s trade war with China. The US-China… Leia mais